Directors and Audit & Supervisory Board Members

- Selection, Dismissal, and Term of Office of Directors

- Directors

- Selection and Term of Audit & Supervisory Board Members

- Audit & Supervisory Board Members

- Independence Guidelines

- Remuneration for Directors and Audit & Supervisory Board Members

- Training Policy for Directors and Audit & Supervisory Board Members

Selection, Dismissal, and Term of Office of Directors

Policy of Selection of Directors

Members of the Board of Directors are selected from candidates inside and outside the company who have impeccable character, extensive experience, broad insight, and advanced expertise. Ideal candidates have the potential to contribute to improved policy-making, decision-making, and oversight befitting a global airline group with widespread businesses centered on the Air Transportation Business. Our selection is made by ensuring diversity in gender, nationality, race, ethnic affiliation, age, or other such factors, and falls within the scope of the Civil Aeronautics Act and other relevant laws.

(i) Internal Directors

In addition to the Chairman who chairs the Board of Directors, the President and CEO, and the CFO, internal directors are selected from candidates that include the President and CEO of ALL NIPPON AIRWAYS CO.,LTD the core company of the Group, corporate executive officers responsible for managing overall Group operations, and group companies' directors that are familiar with Group businesses.

(ii) Outside Directors

Several Outside Directors are selected from among candidates that possess a practical viewpoint based on their vast experience in corporate management or from among candidates that have a global or community-oriented viewpoint owing to a high level of knowledge about social and economic trends, an objective and expert outlook, and who are independent from the Company (based on separately established "Independence Guidelines PDF Opens in a new window.In the case of an external site,it may or may not meet accessibility guidelines.").

Process of Selection or Dismissal of Directors

Candidates are decided by the Board of Directors, taking into the reports by the Personnel Advisory Committee, which is an advisory committee to the Board of Directors. The majority of members on this committee are Outside Directors. In order to ensure transparency and fairness in the selection, the Personnel Advisory Committee discusses the candidates for directors before the Board of Directors makes its resolution.

However, in the event that circumstances arise where a director has violated laws and regulations or the Articles of Incorporation, or when it is otherwise deemed difficult for a director to execute his or her duties, deliberations will be conducted in the Personnel Advisory Committee, and after receiving a report on these deliberations, the Board of Directors will decide whether to submit a proposal to the Ordinary General Meeting of Shareholders concerning the dismissal of such director.

Term of Directors

In accordance with the Articles of Incorporation, the term of office for directors runs until the close of the Ordinary General Meeting of Shareholders for the most recent fiscal year within one year after selection, and does not preclude reappointment.

Directors

- as of June 27, 2024

- For full career background information about the directors see the Management Members.

- These director candidates assumed their positions after being appointed at the 79th Ordinary General Meeting of Shareholders.

- Attendance at board meetings

The Board of Directors strives to maintain an attendance rate of at least 80% at all times, including outside directors. In FY2023, all the 11 directors had 100% attendance. - Number of concurrent positions

In nominating candidates for the Board of Directors, the number of concurrent positions held by candidates is also taken into consideration. All the current directors have four or fewer significant concurrent positions outside the Company.

Directors

| Directors | Material concurrent positions at other corporations, etc. | Reason for electing as Director | Attendance at meetings of the Board of Directors, etc. in FY2023 (Number of Attendance / Number of Meetings Held (Attendance Rate)) |

|---|---|---|---|

| KATANOZAKA Shinya

Chairman of the Board of Directors

|

Outside Director, Tokio Marine Holdings, Inc. Outside Director, Kirin Holdings Company, Ltd. |

Reason for electing as Director | Board of Directors: 13/13(100%) |

| SHIBATA Koji

Representative Director, President and CEO

|

Reason for electing as Director | Board of Directors: 13/13(100%) Personnel Advisory Committee: 4/4(100%) Remuneration Advisory Committee: 3/3(100%) |

|

| HIRASAWA Juichi

Representative Director, Executive Vice President

|

Reason for electing as Director | Board of Directors: 13/13(100%) | |

| NAOKI Yoshiharu

Representative Director, Executive Vice President

|

Reason for electing as Director | Board of Directors: -/- | |

| NAKAHORI Kimihiro

Executive Vice President

|

Reason for electing as Director | Board of Directors: -/- | |

| TANEIE Jun

Executive Vice President

|

Reason for electing as Director | Board of Directors: -/- | |

| INOUE Shinichi

Member of the Board

|

President and Chief Executive Officer of ALL NIPPON AIRWAYS CO., LTD. Chairman of ALL JAPAN AIR TRANSPORT AND SERVICE ASSOSIATION CO., LTD |

Reason for electing as Director | Board of Directors: 13/13(100%) |

Reason for electing as Director:

KATANOZAKA Shinya

KATANOZAKA Shinya has extensive experience in sales, human resources, corporate planning and other disciplines. He was appointed as President and Chief Executive Officer from April 2015 and achieved a profit growth for 4 consecutive years. Upon the management crisis due to COVID-19, he led the Company to immediately ensure liquidity in hand and to prepare and implement structural business reforms and overcame the management crisis due to COVID-19. Since he chairs as Representative Director, Chairman from April 2022 and as Chairman of the Board, Chairman of the Board of Directors from April 2024 and is contributing to the reinforcement of the functions of the Board of Directors, the Company has decided to continue to reappoint him as a Director candidate to attain a sustainable increase in the Group's corporate value.

Reason for electing as Director:

SHIBATA Koji

SHIBATA Koji has extensive experience in sales and marketing, and international alliance and other disciplines. As Member of the Board of Directors and Executive Vice President from June 2020, and as Representative Director and Executive Vice President from April 2021, he was in charge of planning and implementing corporate strategies of the Company. As President and Chief Executive Officer from April 2022, he is in charge of management of the Group while constantly maintaining global perspective and with safety as a top priority. Since he has overcome the management crisis due to COVID-19 and is contributing to the reinforcement of the functions of the Board of Directors based on his abundant experience and performance, the Company has decided to continue to reappoint him as a Member of the Board of Directors candidate to attain a sustainable increase in the Group's corporate value.

Reason for electing as Director:

HIRASAWA Juichi

HIRASAWA Juichi has extensive experience in business planning and corporate planning. As Executive Officer of ALL NIPPON AIRWAYS CO., LTD., a core subsidiary of the Group, from April 2018, he was in charge of planning and implementing corporate strategies of the relevant subsidiary and also created and promoted innovation such as automatic driving of airport vehicles and MaaS. As Member of the Board of Directors of the Company from June 2022, and as Representative Director and Executive Vice President from April 2024, he is mainly engaged in industrial strategies. Since he has overcome the management crisis due to COVID-19 and is contributing to the reinforcement of the functions of the Board of Directors based on his abundant experience and performance, the Company has decided to continue to reappoint him as a Member of the Board of Directors candidate to attain a sustainable increase in the Group's corporate value.

Reason for electing as Director:

NAOKI Yoshiharu

NAOKI Yoshiharu has extensive experience in human resources and sales & marketing. From April 2019, he was in charge of human resources as Executive Officer of ALL NIPPON AIRWAYS CO., LTD., a core subsidiary of the Group and engaged in the review of personnel system, human resources development, and improvement of employee engagement. From April 2024, he is in charge of planning and implementing corporate strategy of the Company and promoting Group Management. Based on the judgment that his abundant experience and expertise are necessary, the Company has decided to appoint him as a new Member of the Board of Directors candidate to attain a sustainable increase in the Group's corporate value.

Reason for electing as Director:

NAKAHORI Kimihiro

NAKAHORI Kimihiro has extensive experience in accounting and finance. As executive officer from April 2020 and as Chief Finance Officer from April 2022, he has secured liquidity on hand during the COVID-19 pandemic and built a stable financial basis. Based on the judgment that his abundant experience and expertise are necessary, the Company has decided to appoint him as a new Member of the Board of Directors candidate to attain a sustainable increase in the Group's corporate value.

Reason for electing as Director:

TANEIE Jun

TANEIE Jun has extensive experience in marketing. As Executive Officer from April 2021 and as Senior Executive Officer from April 2023, she has engaged in spreading and promoting the Group's diversity, equity and inclusion, and has actively reported the achievements at domestic and international conferences and other venues. From April 2024, she is promoting ESG management and risk management. Based on the judgment that her abundant experience and expertise are necessary, the Company has decided to appoint her as a new Member of the Board of Directors candidate to attain a sustainable increase in the Group's corporate value.

Reason for electing as Director:

INOUE Shinichi

INOUE Shinichi was involved in the establishment of Peach Aviation Limited, the first LCC in Japan, and attained its rapid growth as its Representative Director and CEO. He controlled the sales as Representative Director and Executive Vice President of ALL NIPPON AIRWAYS CO., LTD., a core subsidiary of the Group, from April 2020. He is engaged in the management of the relevant company with safety as a top priority in order to regain growth as a global leading airline as its President and Chief Executive Officer from April 2022.

Since he has overcome the management crisis due to COVID-19 and is contributing to the reinforcement of the functions of the Board of Directors based on his abundant experience and performance, the Company has decided to continue to reappoint him as a Member of the Board of Directors candidate to attain a sustainable increase in the Group's corporate value.

Outside Directors

| Outside Directors | Independent | Material concurrent positions at other corporations, etc. | Reason for electing as Outside Director | Attendance at meetings of the Board of Directors, etc. in FY2023 (Number of Attendance / Number of Meetings Held (Attendance Rate)) |

|---|---|---|---|---|

| YAMAMOTO Ado | Independent | Reason for electing as Outside Director | Board of Directors: 13/13(100%) Personnel Advisory Committee: 4/4(100%) Remuneration Advisory Committee: 3/3(100%) |

|

| KOBAYASHI Izumi | Independent | Outside Director of Mizuho Financial Group, Inc. Outside Director of OMRON Corporation |

Reason for electing as Outside Director | Board of Directors: 13/13(100%) Personnel Advisory Committee: 4/4(100%) Remuneration Advisory Committee: 3/3(100%) |

| KATSU Eijiro | Independent | President, Representative Director and Executive Officer of Internet Initiative Japan Inc. Outside Director of Nippon Television Holdings, Inc. |

Reason for electing as Outside Director | Board of Directors: 13/13(100%) Personnel Advisory Committee: 4/4(100%) Remuneration Advisory Committee: 3/3(100%) |

| MINEGISHI Masumi | Independent | President, CEO and Representative Director n of the Board of Recruit Holdings Co., Ltd. Outside Director of Konica Minolta, Inc. |

Reason for electing as Outside Director | Board of Directors: 13/13(100%) Personnel Advisory Committee: 4/4(100%) Remuneration Advisory Committee: 3/3(100%) |

Reason for electing as Outside Director:

YAMAMOTO Ado

YAMAMOTO Ado has offered opinions and proposals regarding safety and quality in public transportation, organization management, and human resources strategy, etc. by leveraging his wealth of experience and expertise in railway business management and in taking leadership in economic association. The Company has decided to continue to reappoint him as Independent Outside Director candidate to expect his contribution in offering continuous supervision and advice on the Company's management in general based on his objective perspective derived from hisrelevant experience and expertise.He was appointed as members of the Remuneration Advisory Committee and the Personnel Advisory Committee in June 2016, and was appointed chair of both the Remuneration Advisory Committee and the Personnel Advisory Committee in June 2020.

Reason for electing as Outside Director:

KOBAYASHI Izumi

KOBAYASHI Izumi has offered opinions and proposals regarding sustainability, corporate governance, and risk management by leveraging her wealth of experience and expertise in corporate management, having served as representative in private financial institutions and international development and finance institutions and as outside director of other various businesses. The Company has decided to continue to reappoint her as Independent Outside Director candidate to expect her contribution in offering continuous supervision and advice on the Company's management in general based on her objective perspective derived from her relevant experience and expertise.

She was appointed as a member of the Remuneration Advisory Committee in July 2013, and a member of the Personnel Advisory Committee in June 2016.

Reason for electing as Outside Director:

KATSU Eijiro

KATSU Eijiro has offered opinions and proposals regarding management strategy, investment control, and risk management by leveraging his wealth of experience and expertise as having served as Administrative Vice Minister and administrative officer, and as manager of ICT company. The Company has decided to continue to reappoint him as Independent Outside Director candidate to expect his contribution in offering continuous supervision and advice on the Company's management in general based on his objective perspective derived from hisrelevant experience and expertise.

In addition, he has been serving as a member of the Remuneration Advisory Committee and the Personnel Advisory Committee from June 2020.

Reason for electing as Outside Director:

MINEGISHI Masumi

MINEGISHI Masumi has led a number of new businesses to success in Recruit Co., Ltd. (currently known as Recruit Holdings Co., Ltd.). As its President and Representative Director from April 2012, he contributed to a significant increase in corporate value through M&A with foreign companies and has offered opinions and proposals regarding business portfolios, new business development, and investment management by leveraging his wealth of experience as a company manager in consumer and service industries. The Company has decided to continue to appoint him as Independent Outside Director candidate to expect his contribution in offering continuous supervision and advice on the Company’s management in general based on his objective perspective derived from his relevant experience and expertise. In addition, he has been serving as a member of the Remuneration Advisory Committee and the Personnel Advisory Committee from June 2022.

- There are no special interests between each Member of the Board of Directors candidate and the Company.

Selection and Term of Audit & Supervisory Board Members

Policy of Selection of Audit & Supervisory Board Members

Audit and Supervisory Board Members are selected from several candidates inside and outside the ANA Group that possesses the vast experience and high level of expertise required to conduct audits to ensure the achievement of healthy development and to bolster the trust society has in the ANA Group. Selection of candidates is made regardless of gender, nationality, or other factors. Note that a minimum of one person with adequate knowledge of finance, accounting and legal affairs is also selected.

At the Annual General Meeting of Shareholders in June 2023, a female attorney was appointed as an outside audit and supervisory board member for the first time.

(i) Internal Audit & Supervisory Board Members

Internal Audit and Supervisory Board Members are selected from among candidates with knowledge and experience in areas including corporate management, finance, accounting, legal affairs, risk management, and the operation of the airline business, and who are capable of gathering information from inside the Group.

(ii) Outside Audit & Supervisory Board Members

Outside Audit and Supervisory Board Members are selected from candidates that are independent from the Company (based on separately established "Independence Guidelines") and who possess a high level of knowledge in various areas, including vast experience in corporate management, a strong insight into areas such as social and economic trends, and adequate knowledge of finance, accounting and legal affairs.

Term of Selection of Audit & Supervisory Board Members

In accordance with the Companies Act, the term of office for an Audit and Supervisory Board Member runs up to the close of the Ordinary General Meeting of Shareholders for the most recent fiscal year, within four years of selection, and does not preclude reappointment.

Audit & Supervisory Board Members

- as of June 27, 2024

- For full career background information about the directors see the Management Members.

Audit & Supervisory Board Members

| Audit & Supervisory Board Members | Material concurrent positions at other corporations, etc. | Reason for election as Audit & Supervisory Board Member | Attendance at meetings of the Board of Directors, etc. in FY2023 (Number of Attendance / Number of Meetings Held (Attendance Rate)) |

|---|---|---|---|

| FUKUZAWA Ichiro | Outside Director of Japan Airport Terminal Co., Ltd. | Reason for election as Audit & Supervisory Board Member | Board of Directors: -/- Audit & Supervisory Board: -/- |

| KAJITA Emiko | Reason for election as Audit & Supervisory Board Member | Board of Directors: -/- Audit & Supervisory Board: -/- |

Reason for election as Audit & Supervisory Board Member:

FUKUZAWA Ichiro

FUKUZAWA Ichiro has been engaged in accounting, finance, and IR for many years. As CFO from April 2017, he has built stable financial basis and attained financial strategy including efficient capital restructuring, and also secured liquidity in hand during the COVID-19 pandemic. As Representative Director, Senior Executive Vice President from April 2022, he has been engaged in preparation and implementation of the Group corporate strategies and has extensive knowledge and experience regarding finance, accounting, and group management. Since audit function can be further enhanced by leveraging his expertise and experience, the Company has decided to appoint him as a new Audit & Supervisory Board Member candidate to attain a sustainable increase in the Group's corporate value.

Reason for election as Audit & Supervisory Board Member:

KAJITA Emiko

KAJITA Emiko has extensive experience in inflight services and customer relations and has extensive expertise and experience in airline business as well as safety, quality of operations, and services. As Executive Vice President of the Company from June 2023, she is also engaged in promotion of ESG management and group risk management.

Since audit function can be further enhanced by leveraging her wide expertise and experience on airline industry, the Company has decided to appoint her as a new Audit & Supervisory Board Member candidate to attain a sustainable increase in the Group's corporate value.

- FUKUZAWA Ichiro and KAJITA Emiko resigned due to resignation from their office as Members of the Board of Directors of the Company as of March 31, 2024.

- FUKUZAWA Ichiro had participated in 13 meetings out of 13 meetings of the Board of Directors, and KAJITA Emiko had participated in 11 meetings out of 11 meetings of the Board of Directors for the Fiscal Year ended March 31, 2024.

Outside Audit & Supervisory Board Members

| Outside Audit & Supervisory Board Members | Independent | Material concurrent positions at other corporations, etc. | Reason for election as Outside Audit & Supervisory Board Member | Attendance at meetings of the Board of Directors, etc. in FY2023 (Number of Attendance / Number of Meetings Held (Attendance Rate)) |

|---|---|---|---|---|

| KANO Nozomu (full-time) |

Independent | Reason for election as Outside Audit & Supervisory Board Member | Board of Directors: 13/13(100%) Audit & Supervisory Board: 13/13(100%) |

|

| OGAWA Eiji | Independent | Professor Emeritus, Hitotsubashi University and a Professor of Faculty of Economics, Tokyo Keizai University | Reason for election as Outside Audit & Supervisory Board Member | Board of Directors: 13/13(100%) Audit & Supervisory Board: 13/13(100%) |

| MITSUHASHI Yukiko | Independent | Reason for election as Outside Audit & Supervisory Board Member | Board of Directors: 11/11(100%) Audit & Supervisory Board:10/10(100%) |

Reason for election as Outside Audit & Supervisory Board Member:

KANO Nozomu

KANO Nozomu has a wealth of experience and expertise in management by having served as corporate executive officer of policy financial institutions and director of private company. The Company has decided to continue to reappoint him as the Independent Outside Audit & Supervisory Board Member for the purpose of reinforcement of the auditing function through the use of his deep insight and knowledge concerning treasury, accounting, finance and legal matters.

Reason for election as Outside Audit & Supervisory Board Member:

OGAWA Eiji

He actively offers advice for matters that require attention on group management strategies from risk management perspective, as well as the Company's financial policies by using his experience and abundant expertise as an international financial expert. The Company has decided to select him as an Outside Audit and Supervisory Board Member for the purpose of reinforcement of audit structure.

Reason for election as Outside Audit & Supervisory Board Member:

MITSUHASHI Yukiko

MITSUHASHI Yukiko has deep insight and knowledge concerning legal matters in general as a lawyer. The Company has decided to appoint her as a new Independent Outside Audit & Supervisory Board Member candidate for the purpose of reinforcement of the auditing function in order to attain sustainable increase in the Group's corporate value through the use of her professional expertise and experience and deep insight.

- Mr. KANO Nozomu was elected at the 78th General Meeting of Shareholders.

Mr. OGAWA Eiji was elected at the 77rd General Meeting of Shareholders.

Ms. MITSUHASHI Yukiko was elected at the 78th General Meeting of shareholders. - There is no special interest between the company where the member holds concurrent positions and the Company.

Independence Guidelines

From the standpoint that Outside Directors bring a different and diverse set of knowledge and experience to the Company which can potentially contribute to the achievement of sustainable growth and improvement in corporate value in the medium- to long-term, Outside Directors are included in the decision-making process for important fundamental management policies, including corporate strategies, and provide advice, supervision and monitoring of business execution.

Please see the Fundamental Policy on Corporate Governance regarding Independence Guidelines PDF Opens in a new window.In the case of an external site,it may or may not meet accessibility guidelines..

Remuneration for Directors and Audit & Supervisory Board Members

Directors' Remuneration

1. Basic Policies for Director Remuneration

The basic policies for director remuneration are as follows:

- Ensure the transparency, fairness, and objectivity of remuneration and establish a remuneration level worthy of his / her roles and responsibilities

- Create a system that can reflect the contributions of individual directors by introducing performance-linked remuneration combining a diverse range of indicators to clarify roles and responsibilities for company results.

- Establish a remuneration system that achieves our social responsibilities as a company, while allowing the Company to share profits with shareholders through raising medium- to long-term corporate value.

From the viewpoint of strengthening governance, the Company has introduced the Malus and Clawback Clause, under which performance-linked compensation is disallowed or reduced in the event of misconduct, effective from compensation for the fiscal year ending March 31, 2024.

2. Procedures for Determining Remuneration

In accordance with the policy above, the Company's compensation for directors is deliberated by the Compensation Advisory Committee, considering compensation levels of other comparable companies, which are researched by an outside specialized organization at the Company's request. The Committee is chaired by an outside director and composed of a majority of outside directors and outside experts, meeting four times a year. The average attendance rate in FY2023 was 100%(3/3). The Committee reports the results of the deliberation to the Board of Directors. Based on the report, the Board of Directors determines the compensation of directors.

- Individual final payments are assessed and determined by the president appointed by the Board of Directors after the president determines the degree of contribution based on the commitment of individual executives and conducts individual interviews.

- In the event of an unexpected rapid change in the business environment, the amount and duration of the reduction are clearly indicated, and the decision to reduce monthly, bonus and stock compensation is left to the President.

3.Remuneration System

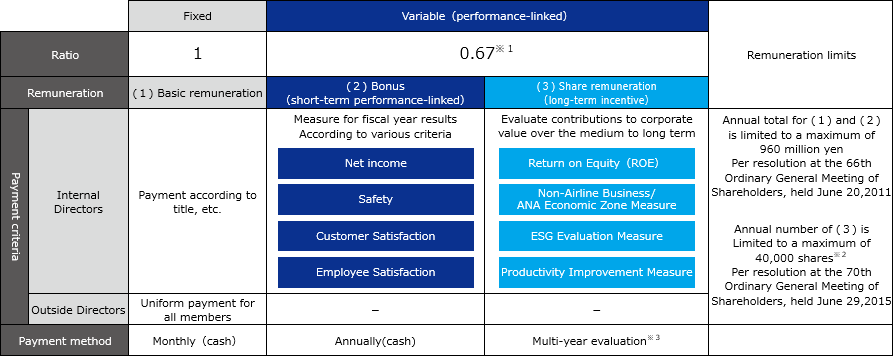

- Remuneration for Members of the Board of Directors (excluding Outside Directors) consists of the basic remuneration, which is set at a level commensurate with the role and responsibility of each position, bonus, which is linked to business results for a single fiscal year, and share remuneration, which is linked to medium- to long- term performance targets.

- When calculating the performance-linked portion, the same factor is used for all positions.

- Remuneration for Outside Directors consists only of the basic remuneration.

- *1. Range from 0 to 0.92 times according to the degree of achievement for performance targets.

- *2. It was resolved at the 70th Ordinary General Meeting of Shareholders held on June 29, 2015 that the maximum of share remuneration per fiscal year would be 400,000 points (i.e. 400,000 ordinary shares of the Company); provided, however, that this represents the number of shares applicable prior to the consolidation of shares effected on October 1, 2017, which is equivalent to 40,000 points (i.e. 40,000 ordinary shares of the Company) after the consolidation of shares.

- *3. For the share remuneration granted during a Member of the Board of Directors' service on the Board, shares (a part of which will be paid in cash equivalent to the market value) will be delivered through a stock delivery trust at the time of his/her resignation.

4. Calculation method

Variable remuneration for directors (excluding outside directors) is calculated in accordance with the following table.

- (1)Bonus (based on FY2024 results, to be paid in July 2025)

The payment coefficient is determined by the sum of the following four indicators. The "%" in the lower box of each indicator is the ratio to the standard performance of 100%. (★Target value)

| Min | 100 billion | 105 billion | ★110 billion | 120 billion | 130 billion | 140 billion | 150 billion | 160 billion |

|---|---|---|---|---|---|---|---|---|

| 0% | 35% | 42.5% | 50% | 57.5% | 65% | 75% | 85% | 92.5% |

| Incidents that have had a significant impact on society in terms of security and safety |

|---|

| Reduction after deliberation by the Committee |

- The Compensation Advisory Committee deliberates whether or not there was a relevant incident. The Committee also deliberates the range of the reduction. Based on the report from the Committee, the Board of Directors decides on reduction.

| Target not achieved | One item (Domestic or international target is achieved) |

★ Two items (Both domestic and international targets are achieved) |

|---|---|---|

| 0% | 10% | 40% |

- NPS: Net Promoter Score of the customer quality evaluation questionnaire conducted twice a year. This fixed-point year-to-year comparison survey is conducted to measure changes from the previous year.

| 4.01pt or less | ★4.02 - 4.22pt | 4.23pt or more |

|---|---|---|

| 0% | 30% | 37.5% |

- Way Survey: Employee satisfaction questionnaire survey conducted annually with all Group employees. This fixed-point year-to-year comparison survey is conducted to measure changes from the previous year.

- (2)Share remuneration (FY2023–FY2025 long-term incentive)

The payment coefficient is determined by the sum of the following four indicators. The "%" in the lower box of each indicator is the ratio to the standard performance of 100% (★Target value).

The share remuneration for the three years from FY2023 to FY2025 is determined based on the results at the end of fiscal 2025. Directors receive share remuneration upon retirement as a director in proportion to the length of their service in the evaluation period.- The following figures are for three years.

| Min | ★12% | 13% or more | 14% or more |

|---|---|---|---|

| 0% | 25% | 37.5% | 50% |

| Min | One item | Two items | ★Three items |

|---|---|---|---|

| 0% | 8.3% | 16.6% | 25% |

- Seven Non-Airline Business companies

ANA X, ANA Trading, OCS, ANA Akindo, ANA Facilities, ANA Business Solutions, ANA Sky Building Service

| Min | One item | Two items | Three items |

|---|---|---|---|

| 0% | 8% | 16% | 25% |

- Reduce emissions by 10% or more compared to the total emissions (ANA/AKX/AJX/APJ/VNL) of 12.33 million tons in FY2019

- ∴Reduce the total emissions (ANA/AKX/AJX/APJ) to 11.09 million tons or less by the end of FY2025

| Target not achieved | 15,900 (Thousand Yen/Person) | ★16,400 (Thousand Yen/Person) |

|---|---|---|

| 0% | 12.5% | 25% |

Numerical calculation method

Income + Personnel expenses

Adjusted number of employees

Audit & Supervisory Board Members' Remuneration

Basic Policy and System for Audit & Supervisory Board Members' Remuneration

Remuneration for both inside and outside Audit & Supervisory Board members consists of fixed compensation (monthly compensation) without a performance-linked portion. This compensation encourages those members to exercise their supervisory functions from an independent standpoint. Remuneration levels for members of the Audit & Supervisory Board are determined in line with remuneration at other companies and in consultation with outside experts.

Payment of remuneration, etc. to members of the Board of Directors and Audit & Supervisory Board Members

(Fiscal year ended March 31, 2024)

| Category | Number of persons entitled to payment | Total amount of remuneration (millions of yen) |

Total amount by remuneration type (millions of yen) | ||

|---|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration | ||||

| Bonus | Share remuneration (non-monetary remuneration) |

||||

| Directors (Outside Directors) |

11(4) | 601(60) | 379(60) | 81(0) | 140(0) |

| Audit & Supervisory Board Members (Outside Audit & Supervisory Board Members) | 6(4) | 144(69) | 144(69) | 0(0) | 0(0) |

| Total | 17 | 745 | 523 | 81 | 140 |

(Notes)

- The above table includes 1 Outside Audit & Supervisory Board Member who resigned at the time 63 of the closing of the 78th Ordinary General Meeting of Shareholders of the Company held on June 27, 2023.

- Since the share remuneration for Members of the Board of Directors are payable based on the performance for the 3 fiscal years from 2023 to 2025, the amount represents an estimate for the Fiscal Year.

- It was resolved at the 66th Ordinary General Meeting of Shareholders of the Company held on June 20, 2011 that the maximum amount of remuneration of Members of the Board of Directors per year would be 960 million yen. The number of Members of the Board of Directors as at the time of the closing of that Ordinary General Meeting of Shareholders was 17 (including 2 Outside Directors). In addition, it was resolved at the 70th Ordinary General Meeting of Shareholders of the Company held on June 29, 2015 that the maximum of share remuneration per fiscal year would be 400,000 points (i.e. 400,000 ordinary shares of the Company); provided, however, that this represents the number of shares applicable prior to the consolidation of shares effected on October 1, 2017, which is equivalent to 40,000 points (i.e. 40,000 ordinary shares of the Company) after the consolidation of shares. The number of Members of the Board of Directors (excluding Outside Directors) as at the time of the closing of that Ordinary General Meeting of Shareholders was 7.

- It was resolved at the 74th Ordinary General Meeting of Shareholders of the Company held on June 21, 2019 that the maximum amount of remuneration of Audit & Supervisory Board Members per year would be 180 million yen. The number of Audit & Supervisory Board Members as at the time of the closing of that Ordinary General Meeting of Shareholders was 5 (including 3 Outside Audit & Supervisory Board Members).

- Figures in the table have been rounded down to the nearest million yen.

Training Policy for Directors and Audit & Supervisory Board Members

Internal directors aim to continually acquire knowledge. They attend external seminars on finance, accounting and compliance at the time of appointment, and based on their level of knowledge and experience, continue to attend external seminars after their appointment and receive private coaching when necessary. The Company provides necessary support for this self-improvement. Furthermore, group training for directors and Audit and Supervisory Board Members, along with lectures and exchanges of opinions with external instructors are periodically carried out to provide information and knowledge required by directors to fulfill their roles. Internal Audit and Supervisory Board Members, upon appointment, take external seminars on accounting and finance should they have no experience in working at the accounting or finance divisions. Also, after appointment, depending on their level of knowledge and experience, they participate in seminars on various topics, including auditing methods, ESG, risk management and compliance. The Company provides the necessary support for internal Audit and Supervisory Board Members to carry out this self-improvement.

At the time of appointment, Outside Directors and Outside Audit and Supervisory Board Members are provided with explanations of the Group's operations to deepen their understanding of the Group and the airline industry. After their appointment, they are given the opportunity to tour sites and facilities, including airport handling, aircraft maintenance, flight operations and passenger cabins. In addition, ongoing training is being implemented, covering topics such as basic knowledge on the airline industry, and explanations of business operations at major subsidiaries.