Environmental Targets and Information Disclosure

ANA Group Environmental Targets

"2050 Environmental Goals" & "2030 Environmental Targets"

- We are working to decarbonize the air transport business by utilizing new technologies, while at the same time protecting the employment of Group employees by expanding profit opportunities through the use of data assets. To this end, in addition to the above initiatives, we have launched a specialized Organization specializing in environmental measures for aviation business, provided new education for training digital specialists, and strengthened communication with customers and labor unions through the ANA Future Promise. In addition, the ANA Group is encouraging the Japanese government to formulate policies for the stable procurement of SAF, which is essential for decarbonization, and our opinions are reflected in the Clean Energy Strategy (interim arrangement).

"2030 Environmental Targets" Progress and Results

Reduce CO2 Emissions (Aircraft operation)

8.9%(11million tons)

8.9%(11million tons)

- Target

By FY2030 - 10%+ reduction vs. FY2019

(Well below approx. 11.1 million tons levels), net - Actual FY2024

- 8.9% reduction

11.23 million tons

Reduce CO2 Emissions (Non-Aircraft operation)

Reduced to20.5%

Reduced to20.5%

- Target

By FY2030 - 33%+Reduction

vs. FY2019 - Actual FY2024

- 20.5% reduction

Reduce Resource Waste Rate (Plastics, Paper, etc)

Reduced to57.6%

Reduced to57.6%

- Target

By FY2030 - 70%+reduction

vs. Disposal volume in FY 2019 - Actual FY2024

- 57.6% reduction

Reduce Food Waste Rate (Including In-Flight Meals, etc)

4.1%

4.1%

- Target

By FY2030 - Reduce to less than 3.8%

(FY2019: 4.6%) - Actual FY2024

- 4.1%

Other environmental targets

Measures for Air Pollution

All aircraftmet standards

All aircraftmet standards

- Target

- All aircraft, including leased aircraft, to conform to Chapter 4 of the International Civil Aviation Organization (ICAO) emission standards. 100%

- Actual

- All aircraft in conformance

Adopt62.2%

Adopt62.2%

- Target

- Actively introduce low-pollution vehicle

(Improvement over previous year) - Actual

- Percentage of low-emission vehicles*

62.2% (Previous year:58.2%)

- Fuel cell, electric, hybrid, or emission constraint vehicles

Noise measures

All aircraftmet standards

All aircraftmet standards

- Target

- All aircraft, including leased aircraft, to conform to Chapter 4 of the ICAO noise standards.

- Actual

- All aircraft in conformance

Biodiversity

- Target

- Promoting biodiversity conservation

- Actual

- Coral conservation activities/seminars aimed at eradicating illegal wildlife trade, etc.

Initiatives as an Eco-First Certified Company

In 2008, ANA became the first-ever company in the airline and transport industry to be certified by the Minister of the Environment as an Eco-First Company. We received this honor in recognition of our commitment to social responsibility.

The ANA Group supports and conducts awareness activities for COOL CHOICE, a program led by the Ministry of the Environment to take measures against global warming. Further, we participated in the Plastics Smart forum in 2018. This forum is another initiative of the Ministry of the Environment aiming to reduce marine plastic litter.

Disclosure based on TCFD recommendations

The ANA Group expressed its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) in March 2019, and since then has been disclosing information in accordance with the TCFD recommendations. We will continue to enhance our disclosure content in line with the TCFD recommendations.

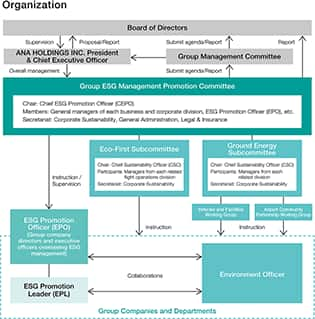

Governance

The ANA Group established the Group ESG Management Promotion Committee in accordance with Group ESG Management Promotion Committee Regulations. This committee, which operates under the guidance of the president and under the chairmanship of the director in charge of corporate sustainability (CEPO: Chief ESG Promotion Officer), consists of ANA HOLDINGS INC. and group company directors, executive officers, and the full-time Audit & Supervisory Board members of ANA HOLDINGS INC. The committee discusses core policies and measures related to ESG management, including risk management and compliance and progress against targets is monitored four times a year.

In addition, important issues directly related to management are discussed at the Group Management Committee and reported to the Board of Directors and the Board of Corporate Auditors.

The Board of Directors is tasked with formulating group-wide management policies and targets, including those related to climate change issues, and is responsible for overseeing the management and business execution of Group companies.

Through regular dialogues with external ESG experts, the ANA Group obtains an understanding of the latest social demands and changes in people's interest in a timely manner, and evaluates their impact on the Group's business and society. The Group incorporates the insight from the evaluation into management strategies and implements the strategies accordingly.

Based on these regulations, each Group company has appointed an ESG Promotion Officer (EPO) as the person responsible for promoting ESG management and participates as a member of the Group ESG Management Promotion Committee, and each Group company and department has an ESG Promotion Leader (EPL) to lead the ESG activities of their respective organization.

Matters discussed, resolved, and reported at the Board of Directors, Group Management Committee, and Group ESG Management Promotion Committee are shared and implemented throughout the entire Group in close collaboration with EPOs and EPLs. We also hold EPL meetings twice a year to share information in a comprehensive manner and promote initiatives at each Group company and department.

In addition, in order to realise the company's sustainable growth and increase its corporate value over the medium and long term, ESG management incorporates an objective and multifaceted approach, with 'CO2 emissions volume' and 'ESG external evaluation indicators', etc are used as evaluation indicators, which are also reflected in the officer remuneration.

Details as below

Examples of climate change related agendas submitted and reported to the Board of Directors thus far

- Formulation of related Policies (Environmental, Biodversity etc.), medium- to long-term environmental targets, and annual results

- Information disclosure in line with the TCFD Recommendations

- Development of a transition strategy to achieve carbon neutrality by 2050

- Incorporating a climate change perspective into the medium-term management strategy

- Progress in the Group's efforts to address climate change issues

Strategy

We conducted scenario analyses (RCP 8.5, RCP 2.6, IPCC Sixth Assessment Report, SDS, NZE scenario, and NDC) based on the 4°C and 1.5°C scenarios*1 established by the United Nations Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA) to identify risks and opportunities that climate change will pose to the Group’s aviation business, determine the impact on income and expenses, and develop countermeasures. The period covered by the analysis is from 2030 to 2050, the years set in the ANA Group Medium- to Long-term Environmental Targets.

- *1.

- 4°C scenario

a scenario in which no action is taken against climate change that exceeds current situation, resulting in a temperature increase by approximately 4°C compared to the level from the Industrial Revolution, and a risk of "physical" changes caused by climate change becoming apparent. - 1.5°C scenario

a scenario in which a radical system transition is achieved, resulting in a temperature increase by less than 1.5°C compared to the level from the Industrial Revolution, and a risk of the "transition" to a low-carbon economy becoming apparent.

- 4°C scenario

Click the image to open the document on scenario analysis

Business impact estimation method and medium- and long-term financial impacts

Based on the scenario analysis, we have identified risks and opportunities with a large financial impact (an annual impact of 10 billion yen or more) and estimated the single-year financial impact on fiscal 2030 and on fiscal 2050. These estimations include potential risks, uncertainties, and assumptions, and the actual scale of impact may therefore widely vary depending on the variability of these factors. Recognizing this, we will incorporate changes in the situation into our evaluations in a timely manner.

- *2. Financial impact:A financial impact expected from the materialization of each identified risk is evaluated on a three-point scale of "large," "medium," and "small." A single-year financial impact is estimated for each of the items classified as large, and the estimation is provided separately for the medium term (through fiscal 2030) and the long term (through fiscal 2050).

Large: ≥10 billion yen per year, Medium: ≥1 billion yen and <10 billion yen per year, Small: <1 billion yen per year - *3. Neither the increases in operational costs nor the increases in the cost of repairing aircraft and facilities damaged by disasters are included (subject to future consideration).

- *4. References: IPCC Sixth Assessment ReportClimate Futures, Infographic TS.1, Infographic TS.1 in IPCC, 2021: Technical Summary. In: Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Chen, D., M. Rojas, B.H. Samset, K. Cobb, A. Diongue Niang, P. Edwards, S. Emori, S.H. Faria, E. Hawkins, P. Hope, P. Huybrechts, M. Meinshausen, S.K. Mustafa, G.-K. Plattner, and A.-M. Tréguier, 2021: Framing, Context, and Methods. InClimate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change[Masson-Delmotte, V., P. Zhai, A. Pirani, S.L. Connors, C. Péan, S. Berger, N. Caud, Y. Chen, L. Goldfarb, M.I. Gomis, M. Huang, K. Leitzell, E. Lonnoy, J.B.R. Matthews, T.K. Maycock, T. Waterfield, O. Yelekçi, R. Yu, and B. Zhou (eds.)]. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA, pp. 147-286, doi:10.1017/9781009157896.003.]

- *5. SAF: Sustainable aviation fuel, a jet fuel produced from sustainable sources that emits less CO2 in the process from raw material production and sourcing to combustion.

- *6. For SAF price forecasts, we used Sustainable Aviation Fuels Mandate-Consultation-stage Cost Benefit Analysis, a document issued by the UK government in 2023.

- *7. Carbon credits: Providing a mechanism to quantify CO2 emissions reductions, carbon credits are tradable as emissions rights.

- *8. For the estimation of financial impacts, prices of carbon credits produced by using negative emissions technologies are assumed to be equivalent to the prices of CORSIA Eligible Emissions Units.

- *9. DAC (Direct Air Capture):A technology that extracts CO2 directly from the atmosphere.

- *10. For the estimation of reductions in fuel procurement costs, we used the fuel price forecast for fiscal 2025 (USD120/bbl), which is applicable to the FY2023-2025 ANA Group Corporate Strategy, and the exchange rate applicable to the latest income and expenditure plan (JPY140/USD1).

- *11. For the estimation of CO2 emissions, the transition strategy uses 3.16 kg-CO2/kg as the emissions factor for jet fuel, which is the same emissions factor as used in the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) of the International Civil Aviation Organization (ICAO).

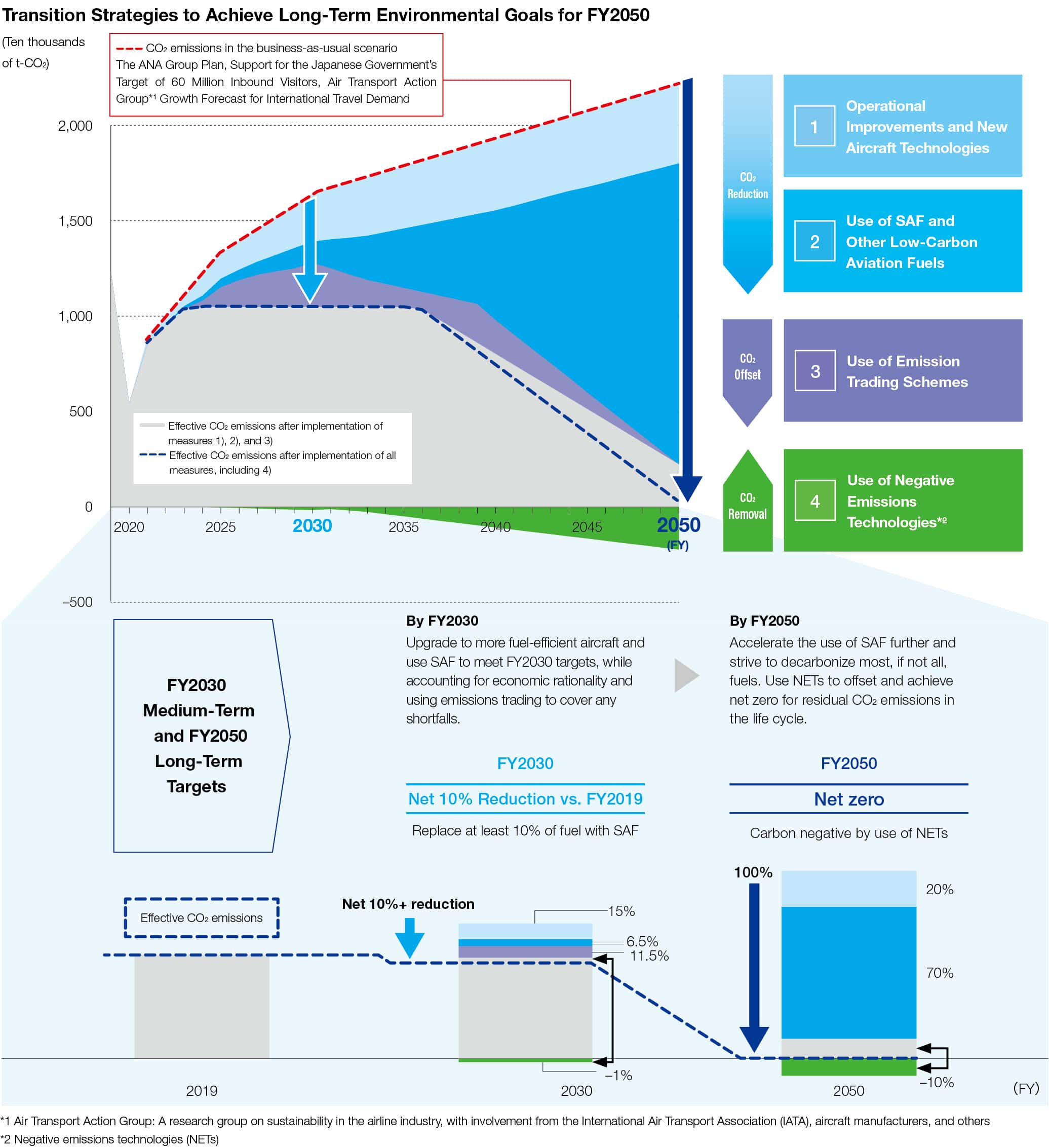

Transition Plan

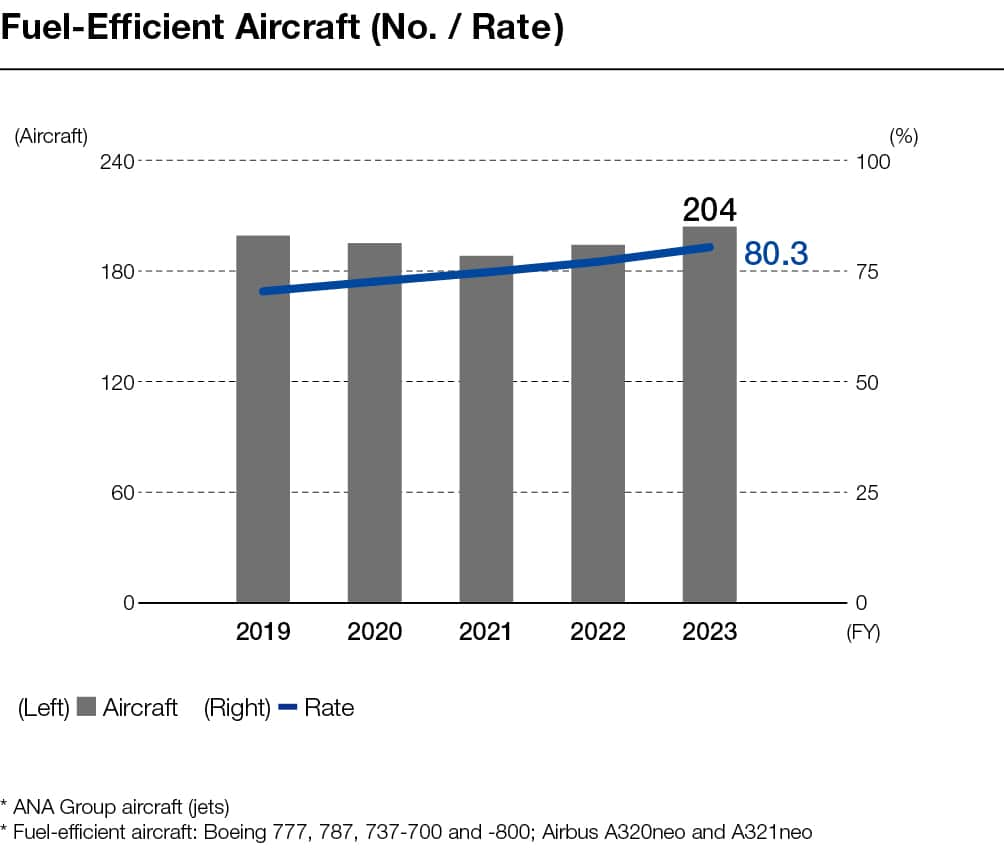

ANA Group has reviewed its mid-term environmental targets for FY2030 and transition strategy to achieve a decarbonized society, and updated its transition scenario toward carbon neutrality by FY2050. By FY2030, we will reduce CO2 emissions on both international and domestic flights by at least 10% compared to FY 2019, net.

To achieve this goal, we will combine four strategic approaches (operational improvements and technological innovation of aircraft, etc., low-carbon aviation fuel through the use of SAF, emissions trading, and negative emission technologies*1), with the use of SAF at the core.We will achieve carbon neutrality by 2050 while also pursuing compatibility with economic rationality.

FY2030

Pathway to "10%+ reduction vs. FY2019", net

- Review of reduction targets for international aviation at ICAO General Assembly

- Replace jet fuel to SF F by 10% and over

- Breakdown of emission reduction

Technological innovation 15% / Utilization of SAF 6.5% / Utilization of Emissions Trading Scheme 11.5% / NETs 1%

FY2050

Road to Net zero emissions

- Carbon negative by use of NETs

- Emission Reduction Breakdown (100%)

Technological innovation 20%/Utilization of SAFs 70%/NETs 10%

- *1.Negative Emissions Technologies (NETs): CO2 removal technologies that capture, absorb, store, and immobilize CO2 in the atmosphere.

Details as below

Financial Plan

The ANA Group established the Green Bond Framework on August 1, 2022, to procure funds necessary for implementing transition strategies. The funds will be used to purchase SAF, as well as to make investments aimed at increasing the procurement of SAF and utilizing negative emissions technologies.

Green Bond Framework PDF Opens in a new window.In the case of an external site,it may or may not meet accessibility guidelines.

Risk Management

Risk Management System

The Group ESG Management Promotion Committee formulates and implements basic measures and progress monitoring in accordance with the fundamental policy decided by the Board of Directors and the ANA Group Total Risk Management Regulations, which stipulate the basic terms of the group's risk management system.

At each Group company, a risk management organization is in place with an ESG Promotion Officer (EPO) and an ESG Promotion Leader (EPL) serving as the risk management supervisor and the person in charge of risk management activities, respectively.

Risks related to climate change are recognized as significant and handled within the framework of total risk management.

Total Risk Management Framework

Each Group company has established a framework using a risk management cycle (identifying, analyzing, and assessing a risk; examining and implementing risk management and reduction measures; and monitoring) to minimize risks. Every year, each Group company conducts business-specific risk assessment to identify risks. With regard to significant risks identified, necessary measures are taken and their progress, effectiveness and level of achievement are confirmed and evaluated. For issues including climate-related risk considered as requiring Group-wide approaches, General Administration takes the lead in implementing measures, and their progress is reported to the Group ESG Management Promotion Committee. In addition, matters that need to be reflected in policies and strategies of the Group are submitted to the Board of Directors.

Major Risks for the ANA Group

- Safety is compromised and impeded.

- Effects of infectious diseases

- Addressing climate change issues

- Destabilization of global situations

- Occurrence of system failures

- Information leaks

- Human rights risks

- Intensifying natural disasters

- Market fluctuations, including exchange rate, oil price and interest rate fluctuations

- Investment intended to increase competitiveness and achieve new growth

- Shrinking of existing markets and difficulty in securing workforce due to population decrease

- Intensifying competition with land transportation

Metrics and Targets

The Group has set out its '2050 Long-term Environmental Goals' and declared itself carbon neutral by 2050, and as a pathway to realising this, we have set '2030 Mid-term Environmental Goals' and are working to reduce our environmental impact.

ANA Group Medium- and Long-Term Environmental Targets related to CO2 emissions

| FY2030 | FY2050 | |

|---|---|---|

| CO2 emissions generated by aircraft flight operations | 10%+ reduction vs. FY2019 (Well below approx. 11.1 million tons levels), net |

Net zero |

| CO2 emissions generated by all non-aircraft flight operations. | 33%+ reduction (vs FY2019) | Net zero |

Details as below

Efforts to reduce CO2 emissions

Data

Details as below

Internal Carbon Pricing (ICP)

ANA HOLDINGS INC. was selected to take part in the Ministry of the Environment's FY2022 Model Project of Using the Internal Carbon Pricing (ICP) Mechanism in Investment Decisions. In the future, ANA will establish and operate multiple categorized ICP schemes for a broad range of initiatives to ensure highly useful and effective investment (application to investment decision-making), with a view to complying with regulations and achieving targets.

Other disclosure on Climate Change

Evaluation by Carbon Disclosure Project (CDP)

In response to investor requests for disclosure, the Carbon Disclosure Project (CDP) assessment is aimed at disclosing information on greenhouse gas emissions and corporate strategies for climate change. Since fiscal 2016, the ANA Group has disclosed greenhouse gas emissions data corresponding to Scope 1, 2, and 3 as defined in the Act on the Rational Use of Energy. This data is verified for accuracy by a third-party agency. We are pleased to announce that we have been recognized by CDP as an "A List company" for 2024 for our leadership in transparency and performance in corporate sustainability on climate change. Among the companies selected this year, we are the only airline group in the world to be selected for three consecutive years.

CDP website Opens in a new window.In the case of an external site,it may or may not meet accessibility guidelines.

ANA HOLDINGS Earns Third Consecutive CDP Climate Change 'A List' Spot as the Only Airline Group Worldwide Opens in a new window.In the case of an external site,it may or may not meet accessibility guidelines.

Science-Based Targets(SBT)

In November 2022, our greenhouse gas (CO2) emission reduction targets, which are based on scientific evidence, were approved as science-based targets (SBT) by Science Based Targets Initiative (SBTi), an international initiative. The ANA Group will continue to promote value creation in ESG management toward "Net Zero Emissions by 2050" using this target as a roadmap.

"As the First Airline in Asia, ANA Group's Target to Reduce CO2 Emissions Approved by the SBTi" Opens in a new window.In the case of an external site,it may or may not meet accessibility guidelines.

as of 31/07/2025

|

Sources |

Science-Based targets by FY 2030 |

Fiscal Year |

|||

|---|---|---|---|---|---|

|

Aircraft operation Well to Wake*1 |

Reduce carbon intensity by 29 % compared to FY 2019 levels kg-CO2/RTK |

2019 |

2022 |

2023 |

2024 |

|

0.926 |

1.100 |

1.089 |

0.985 |

||

|

Non Aircraft operation Facilities and Vehicles |

Reduce CO2 emissions by 27.5 % compared to FY 2019 levels t-CO2 |

2019 |

2022 |

2023 |

2024 |

|

125,631 |

94,685 |

96,997 |

114,762 |

||

- *1: Emissions from the entire process of fuel production, delivery, and combustion of fuel

- *2: Revenue Ton-Kilometers (100kg per passenger)