ANA HOLDINGS Becomes

World's First Airline to Issue Green Bonds

- •ANA HD will offer Green Bonds to raise funds for a new training center with high environmental performance.

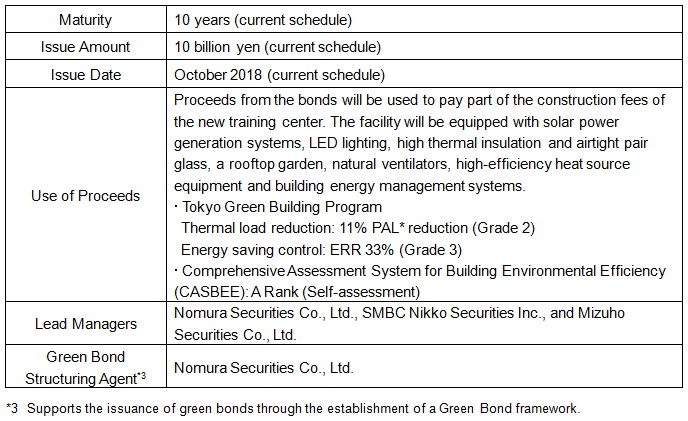

TOKYO, Sept. 28, 2018 - ANA HOLDINGS INC. (hereinafter "ANA HD") announced today that it publically will offer Green Bonds*1 in the amount of 10 billion yen within the Japanese domestic market in October. ANA HD will be the world's first company in the global airline business sector to issue Green Bonds. Through this initiative, ANA HD aims to raise funds for the new training center, which has a high environmental performance, currently being built in Ota-ku, Tokyo.

*1 The bonds issued by companies, local governments, or other organizations to raise funds for domestic and overseas green projects.

In February, the ANA Group announced its FY2018-2022 Mid-Term Corporate Strategy, which describes how it will achieve sustainable growth and value creation focusing on ESG*2 management. ANA HD defined Environment, Human Rights, Diversity and Inclusion and Regional Revitalization as its four main pillars and incorporated them into its strategy. Through this strategy, the ANA Group will create both social and economic value to enhance its corporate value. With increasing popular demands regarding ESG-related initiatives, ANA HD is actively finding ways to address and achieve the United Nation's Sustainable Development Goals (SDGs) as a global company.

*2 Acronym stands for Environment, Social and Governance.

ANA HD decided to issue the Green Bonds to further enhance stakeholders' recognition of its environmental and social responsibility initiatives. Past recognitions include, in 2008, ALL NIPPON AIRWAYS CO., LTD. (ANA) becoming the first-ever company in the airline and transport industry certified by the Minister of the Environment, Government of Japan (MOEJ) as an Eco-First Company.

The training center will be built with the most advanced equipment to meet growing demand in the future airline business. Through the training held at the facility, the ANA Group will further improve safety, the foundation of its business, and enhance development and training of its employees, who are the source of ANA HD's quality services. ANA HD will continue to emphasize these values and introduce fuel-efficient aircraft such as the Boeing 787 and Airbus A320neo/A321neo, in effort to become the world's leading environmental airline group.

【Summary of the Green Bonds】

For the issuance, ANA HD established a Green Bond framework based on Green Bond Principles 2018*4 and Green Bond Guidelines, 2017*5 published by MOEJ. To ensure our eligibility for the Green Bonds, we acquired the highest grade, "GA1", and a second opinion from Rating and Investment Information, Inc. (R&I) through an "R&I Green Bond Assessment*6".

Additionally, R&I has received the notification of Green Finance Organization JAPAN's decision to grant a subsidy as part of the Financial Support Programme*7 for Green Bond Issuance by MOEJ.

*4 The guideline regarding Green Bond Issuance is written by Green Bond Principles Executive Committee which is facilitated by ICMA (International Capital Market Association).

*5 MOEJ has established "the Green Bond Guidelines, 2017" in March 2017 with the purpose of spurring issuances of Green Bonds and investments in them in Japan. The Guidelines, with due consideration to the consistency with the GBP, which is widely accepted in the Green Bond markets in the world, provide issuers, investors and other market participants with illustrative examples of specific approaches and interpretations tailored to the characteristics of the Japan's bond market which will aid these market participants to make decisions on working-level matters related to Green Bonds.

MOEJ's website: Green Bond Guidelines, 2017

http://www.env.go.jp/en/policy/economy/gb/guidelines.html![]()

*6 R&I Green Bond Assessment is R&I's opinion regarding the extent to which the proceeds from the issuance of green bonds are used to invest in projects with environmental benefits on a scale from 1 to 5. In conjunction with this assessment, R&I may provide second opinions on green bond frameworks. R&I Green Bond Assessment is not an evaluation of the creditworthiness of the instrument assessed.

R&I's website: R&I Green Bond Assessment

https://www.r-i.co.jp/en/rating/products/green_bond/index.html![]()

*7 A programme where subsidies will be provided for the expenses that are required by those who support companies, municipalities and other bodies who seek to issue Green Bonds, in the form of granting external reviews, consultation on establishing a Green Bond framework, etc.

- 【Eligibility Criteria of a Green Bond】

- (1) A Green Project that meets one of the following criteria:

- ① Contributes mainly to domestic decarbonization (renewable energy, energy efficiency, etc.)

・Projects for which equal to or more than half of the procured amount, or equal to or more than half of the number of projects is domestic decarbonization-related project. - ② Has high decarbonization and effects on vitalization of local economy

・Decarbonization effects

Those whose subsidy amount per ton of domestic CO2 reduction is less than the specified amount.

・Effects on vitalization of local economy

Projects that are expected to contribute to effects on vitalization of local economy as part of the ordinance and plan, etc. decided by the municipality, projects for which investment by municipalities can be anticipated, etc.

- (2) Compliance with the Green Bond Guidelines to be confirmed by an external review organization before issuance.

- (3) It cannot be "Green wash" bonds.

MOEJ's website: Green Bond Issuance Promotion Platform

http://greenbondplatform.env.go.jp/en/

Contact: ANA Corporate Communications, TEL +81-3-6735-1111, publicrelations@ana.co.jp

About ANA

Following the "Inspiration of Japan" high quality of service, ANA has been awarded the respected 5-Star rating every year since 2013 from SKYTRAX. ANA is the only Japanese airline to win this prestigious designation six years in a row. Additionally, ANA has been recognized by Air Transport World as "Airline of the Year" three times in the past 10 years - 2007, 2013 and 2018, becoming one of the few airlines winning this prestigious award for multiple times.

ANA was founded in 1952 with two helicopters and has become the largest airline in Japan, as well as one of the most significant airlines in Asia, operating 85 international routes and 121 domestic routes. ANA offers a unique dual hub model which enables passengers to travel to Tokyo and connect through the two airports in the metropolitan Tokyo, NARITA and HANEDA, to various destinations throughout Japan, and also offers same day connections between various North American, Asian and Chinese cities.

ANA has been a member of Star Alliance since 1999 and has joint venture partnerships with United Airlines, Lufthansa German Airlines, Swiss International Airlines and Austrian Airlines.

Besides the full service and award winner carrier ANA, the ANA Group has two LCCs as consolidated subsidiaries, Vanilla Air Inc. and Peach Aviation Limited. The ANA Group carried 53.8 million passengers in FY2017, has approximately 39,000 employees and a fleet of 260 aircraft. ANA is a proud launch customer and the biggest operator of the Boeing 787 Dreamliner.

For more information, please refer to the following link.

https://www.ana.co.jp/group/en/