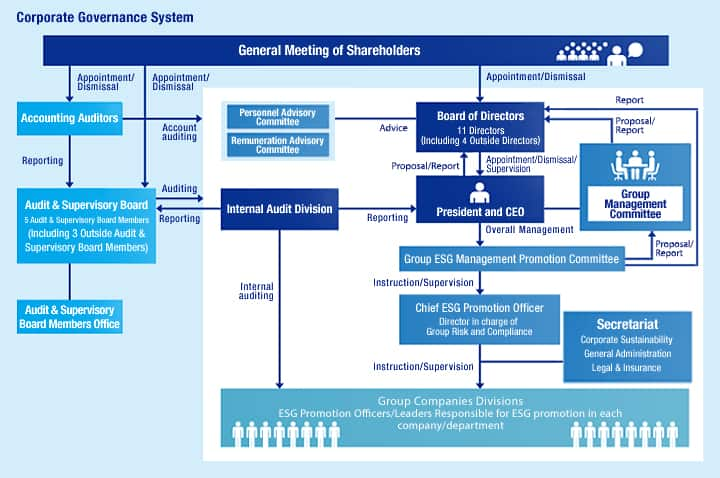

Corporate Governance Structure

Corporate Governance Structure

General Meeting of Shareholders

Directors and Board of Directors

The Board of Directors sets the groupwide management policies and goals while also taking on the role of overseeing the management and business execution of each group company.

The Board of Directors is to be adequately composed of members including experience, knowledge, and expertise, to facilitate ample discussion, swift and rational decision-making and the supervision and monitoring of business execution. There are 9 male directors and 2 female director sitting on the Board of Directors.

From the Annual General Meeting of Shareholders in June 2022, the Company has appointed four independent outside directors, achieving its goal to have a Board with outside directors exceeding one-third of all directors. The four outside directors have been registered as "independent officers" with the Tokyo Stock Exchange.

The Company is incorporated as a company with an audit and supervisory board. The board comprises five members, three of whom are outside audit and supervisory board members with a high degree of independence. The three outside audit and supervisory board members have been registered as "independent officers" with the Tokyo Stock Exchange.

In addition to the 11 directors, the five Audit & Supervisory Board members participate in meetings of the Board of Directors to facilitate swift and appropriate decision-making and reinforce supervisory functions.

Analysis and Evaluation of Effectiveness of the Board of Directors

Method of Evaluation

The Company recognizes that it is important the Board of Directors constantly look for new solutions while always thinking of how to improve the efficacy of the Board of Directors and corporate governance. Moreover, at least once a year the Company analyzes, evaluations and deliberations regarding the efficacy of the Board of Directors overall, engaged in efforts to resolve the issues identified during this process, and intend to improve the functionality of the Board of Directors by initiating a PDCA cycle wherein we perform this evaluation again at the end of the fiscal year.

With respect to FY2021, in order to further improve objectivity and transparency of evaluations, we carried out an evaluation with the help of a third-party organization, Sumitomo Mitsui Trust Bank, and it confirmed the efficacy of the board of directors. For FY2022, we decided to conduct another internal efficacy evaluation (we plan to continue having evaluations conducted by third-party organizations about once every three to five years going forward).

In December 2024, the Company carried out an analysis and evaluation of the overall efficacy of the Board of Directors using a questionnaire survey for all Directors and Audit and Supervisory Board Members, Additionally, from February to March 2025, the Company carried out an interview of questionnaire results for the chairman of the Board, President, all Outside Directors and Audit and Supervisory Board Members. The results of evaluation of the effectiveness of the Board of Directors confirmed at the Board of Directors held on March 25, 2025.

Results of the Analysis and Evaluation of the Efficacy of the Board of Directors

The survey confirmed that active discussions were taking place at the Board of Directors by an adequate level of support provided to Outside Directors and Outside Audit and Supervisory Board Members, who possess diverse experience and expertise, in areas such as preliminary briefings highlighting key issues for the Board of Directors, briefings on management strategies, and direct interviews with management members of departments. In addition, by reviewing the regulations of the Board of Directors and organizing the agenda items to be submitted, as well as securing opportunities for discussion on medium-term management strategy, we confirmed that active discussions are taking place at the Board of Directors.

The survey assessed that the Company's Board of Directors is functioning properly, and that it has sufficient efficacy to ensure decisions on key management issues are appropriately made and business operations are suitably supervised. Whereas we have confirmed improvement points that will further enhance the supervisory functions of the Board of Directors through modifications to meeting operations etc. Based on the evaluation of the efficacy of the Board of Directors, the Company aims to continue to improve the efficacy of its Board of Directors moving forward.

Please see the Corporate Governance section in our latest Integrated Report for more details.

Voluntarily Established Committees

As advisory bodies to the Board of Directors, the company has established the Personnel Advisory Committee*1 and the Remuneration Advisory Committee, which are both membered by a majority of outside directors. With these committees in place, we strive to improve the transparency and impartiality of our corporate governance system.

- *1.The Personnel Advisory Committee was established in June 2016.

Personnel Advisory Committee

The Committee is composed of five members-four Outside Directors (Chairman, YAMAMOTO Ado, KATSU Eijiro, MINEGISHI Masumi and INOUE Yukari) and one Internal Director (SHIBATA Koji). It discusses the appointment of candidates to the post of director as well as the dismissal of directors, and reports to the Board of Directors. In order to ensure fairness and transparency in the process of selecting candidates for the post of director, the Committee is chaired by an Outside Director, and has met 4 times during fiscal 2024.

Remuneration Advisory Committee

The Committee is composed of seven members-four Outside Directors (Chairman, YAMAMOTO Ado, KATSU Eijiro, MINEGISHI Masumi and INOUE Yukari) , one Outside Audit Supervisory Board Member (KIKUCHI Shin), one Internal Director (SHIBATA Koji) and one outside expert (OCHIAI Seiichi). It discusses directors' remuneration. and reports to the Board of Directors. These discussions take into account remuneration levels at other companies based on the findings of a third-party research institute employed by the Company. In order to ensure fairness and transparency in the process of deciding remuneration, the Committee is chaired by an Outside Director, and has met 3 times during the fiscal 2024.

Audit & Supervisory Board and Audit & Supervisory Board Members

To ensure healthy development and to earn greater levels of trust from society through audits, the company has appointed five Audit & Supervisory Board members, three of which are outside Audit & Supervisory Board members, that possess plentiful experience and the high level of expertise required to conduct audits.

Audits by the Audit & Supervisory Board are conducted by full-time Audit & Supervisory Board members that are well-versed in the group's business and highly independent outside Audit & Supervisory Board members, and the full-time outside Audit & Supervisory Board member, who has experience working at financial institutions, serves as the main proponent of these audits. The Audit & Supervisory Board Members Office was established and placed under the direct control of the Audit & Supervisory Board members to provide support for audits. This office cooperates with the Internal Audit Division, which is directly under the supervision of the CEO, and the accounting auditors, to enhance the company's auditing system. The three outside Audit & Supervisory Board members are registered as independent auditors with the Tokyo Stock Exchange.

Accounting Auditors

The accounting auditors perform audits of ANA HOLDINGS INC. and group companies in accordance with the Companies Act of Japan and the Financial Instruments and Exchange Act of Japan. The accounting auditors prepare for the introduction or amendment of various laws and regulations, accounting standards, and other rules by allowing sufficient time for discussions to take place with the company's finance division.

Following the closure of the 71st Ordinary General Meeting of Shareholders, the company newly appointed Deloitte Touche Tohmatsu LLC as its accounting auditor.

Accordingly, future audits are carried out by certified public accountants from this firm.

| Compensation paid for audit certification activities (millions of yen) |

Compensation paid for non-audit activities (millions of yen) | |

|---|---|---|

| ANA HOLDINGS INC. | 90 | 18 |

| Consolidated Subsidiaries | 209 | 5 |

| Total | 299 | 23 |

Principal Internal Committees

Group Management Committee

The company has established the Group Management Committee, comprising the president and CEO, who acts as the chairman, as well as full-time directors, full-time Audit & Supervisory Board members, and other members, to discuss measures needed to address management issues more swiftly and in greater detail. The committee fulfills a supplementary role to the Board of Directors.

Group ESG Management Promotion Committee

Under the Group ESG Management Promotion Committee Regulations, the company has established the Group ESG Management Promotion Committee, which promotes the advancement of formulated measures and reports directly to the president and CEO. The committee comprises the full-time directors and full-time Audit & Supervisory Board members. Policies and issues of significance related to the group's ESG management promotion as a whole, including those pertaining to risk management and compliance, are discussed and proposals are made by this committee.

Meeting of Bodies Responsible for Corporate Governance (Fiscal year ended March 31, 2025)

| Board of Directors | 12 |

|---|---|

| Audit & Supervisory Board | 13 |

| Management Committee | 63 |

| Group ESG Management Promotion Committee Regulations | 4 |