ANA HOLDINGS NEWS

ANA HOLDINGS Unveils Long-term Strategic Vision and Updates on FY2014-2016 Mid-term Corporate Strategy

TOKYO, January 30, 2015 - ANA HOLDINGS (hereafter “ANA HD”) today unveils its long-term corporate strategic vision for the ten-year period up to FY2025 and provides an update on the progress of its mid-term corporate strategy for FY2014-2016.

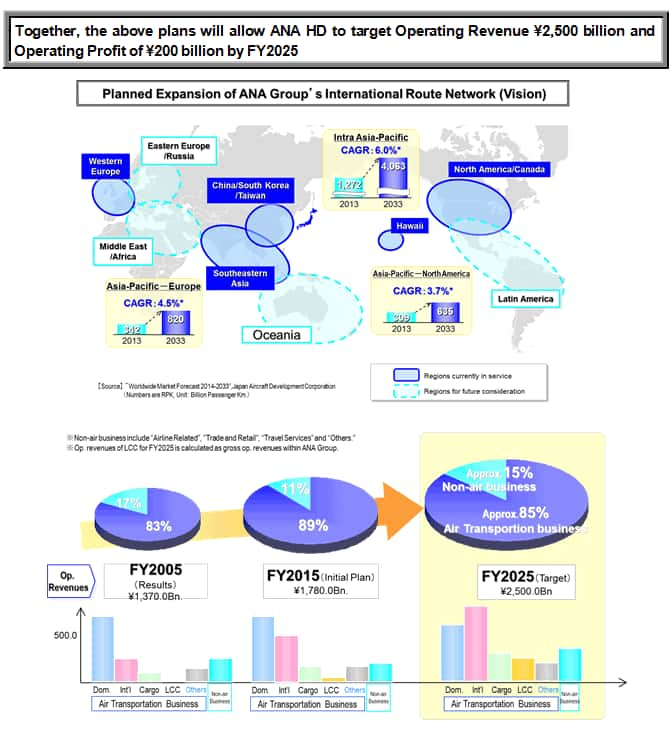

The ten-year vision is designed to take advantage of the possible further expansion of takeoff and landing slots at airports in Tokyo metropolitan area, the boost that the 2020 Tokyo Olympics and Paralympics will provide to the Japanese economy and growing inbound tourism. Key targets include:

| ・ | An increase in operating revenue to ¥2,500 billion and an operating profit target ¥200 billion | |

| ・ | Growth in international passenger services of 50% from FY2015 to FY2025 | |

| ・ | A further expansion of the group’s airline fleet including orders for 15 new aircraft announced today |

With respect to the FY2014-FY2016 mid-term corporate strategy, ANA HD confirms that:

| ・ | The group remains on course to achieve a planned ¥136.5 billion in cost savings from FY2011 by the end of FY2016 |

|

| ・ | Management targets for improvements in revenue, operating profit and operating margin remain unchanged | |

| ・ | Further development of the Tokyo dual-hub airport strategy, Narita and Haneda, will take place. |

10-Year Outlook and ANA HD's Strategic Goals

Over the next ten years, Japan’s population is expected both to decline and grow older as a result of the falling birth rate, presenting economic and fiscal challenges for the country and its airline industry. However, at the same time, Japan will receive a major boost by hosting the Olympic and Paralympic Games in 2020, by which time the country is targeting an increase in overseas visitor numbers to 20 million a year. Also, further expansion of slots at Tokyo metropolitan airports are expected to happen. Outside Japan, the global economy is also expected to continue growing, driven mainly by Asia. ANA HD’s long-term strategic vision and its growth strategy to FY 2025 is planned against this backdrop.

1. Key Strategic Plans for Each Business Segment

| International Passenger Services | |||

| ANA’s international services will become its core business, increasing profitability with the launch of new routes and positioning the group as Japan’s ‘bridge to the world’. To achieve this, ANA will focus investment to meet increased demand between North America and Asia. It will: | |||

| ・ | Capture an increasing share of the growing demand for travel to Japan | ||

| ・ | Target a 50% increase in revenues by FY2025 so that international overtakes domestic revenue | ||

| Domestic Passenger Services | |||

| In a market where gradual shrink is expected, ANA aims to maintain market share and improve efficiencies by: | |||

| ・ | Increasing profitability through “dynamic fleet assignment”- matching aircraft size to peaks and troughs of demand | ||

| ・ | Making more effective use of infrastructure and resources | ||

| Cargo services | |||

| ANA aims to capture the growing global demand by positioning itself as a leading combination cargo carrier utilizing both freighter and passenger aircraft. In particular, it will: | |||

| ・ | Capture intra-Asia cargo demand by expanding its network from/to the Okinawa hub | ||

| ・ | Expand its trans-Pacific capacity through joint venture partnerships to improve competitiveness | ||

| LCC | |||

| ANA HD will expand its LCC as its fourth core business by meeting increased demand from passengers travelling within Japan and from/to overseas destinations. | |||

| Non-Air business | |||

| This division will remain ANA HD’s fifth core business segment through the development of new businesses and the strict assessment of existing businesses. | |||

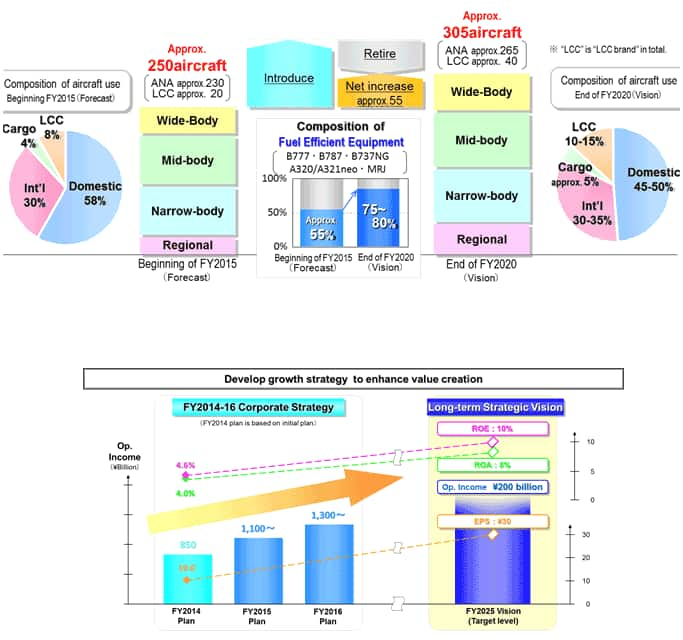

2. Fleet Expansion Underpinning Long-term Growth Strategies

ANA HD's announced last March for 70 new aircraft to support its growth and to replace some existing older planes. In addition to this, ANA HD today announces orders for 15 new aircraft to enable further flexibility of aircraft to match demand and to take advantage of the expected increase in airport slots in the Tokyo area. The new order consists of three Boeing 787-10s, five Boeing 737-800s, and seven Airbus A321s.

By the end of FY2020 ANA HD expects its total fleet to number approximately 305 aircraft, of which ANA will operate approximately 265 and LCCs approximately 40. The comparable figure for the beginning of FY2015 will be 250 aircraft - of which 230 will be operated by ANA and 20 by LCCs.

Update on ANA HD Mid-term Corporate Strategy FY2015-2016

1. Optimizing Business Portfolio

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

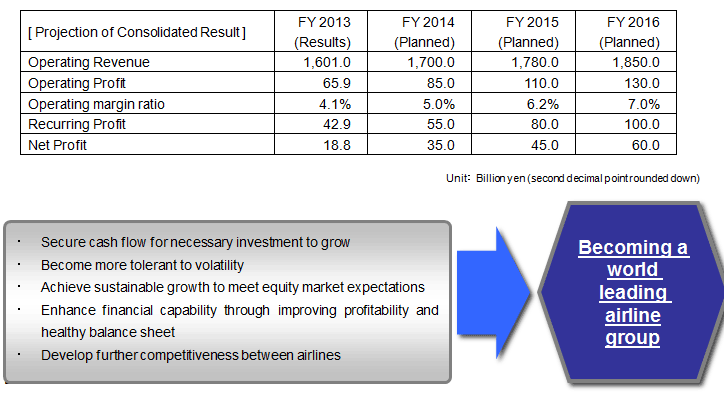

2. Cost Restructuring to Improve Competitiveness

ANA HD has a current target of reducing cost by a total of ¥136.5 billion between FY2011 and 2016. It will achieve ¥86.5 billion in cost reduction (including ¥34.0 billion as planned in FY2014) by the end of FY2014 and further reduction of ¥50.0 billion is planned between FY2015 and 2016. These savings will reduce unit costs* by ¥1.5.* Reduction from beginning of FY2011. Fuel expenses are not included.

3. Management Targets for FY2015-FY2016

ANA HD’s targets over the two-year period are unchanged.

Target Operating Profit ¥130.0 billion, Operating margin ratio 7.0% in FY2016

Contact: ANA HOLDINGS Public Relations TEL +81-3-6735-1111

About ANA HOLDINGS INC.

ANA HOLDINGS is an aviation group with global operations and a total of 63 consolidated subsidiaries and 18 equity method affiliates. It is divided into passengers and cargo business segments as well as airline related business such as Catering and IT Services.

ANA HD formed in April 2013 and is the parent company of ANA; full service carrier and Vanilla Air; LCC.

ANA HD promotes a multi-brand strategy to leverage the strength of ANA brand and stimulate demand in markets not completely covered by its full-service airline offering, while expanding market share for the Group as a whole, leading to enhanced value.

ANA HD has about 240 aircraft flying to 81 destinations and carrying about 46 million passengers. ANA is the largest airline in Japan by passenger numbers.

Management vision of ANA HD is “It is our goal to be the world’s leading airline group in customer satisfaction and value creation.” ANA is a member of Star Alliance.